How to Crypto Trading? Before you can start trading with cryptocurrency, you must know how to create an account. You will need a valid email address and a strong password. You will also need to verify your account by sending a verification email with a verification code. Once you have verified your account, you can deposit your initial capital. You can choose among a variety of deposit methods to fund your account.

Investing in cryptocurrencies

Cryptocurrency trading can be a lucrative way to make money. However, you must be aware of the risks that come with cryptocurrency. Unlike other investments, crypto values are volatile and can spike up or crash at any time. Therefore, if you are new to this type of investment, it is important to do your homework first.

First, it is important to research the different types of cryptocurrencies. There are thousands of digital coins, and the number is growing. You must know which type to invest in, how it works, and how it differs from other types of crypto. You can learn more about the different types of crypto by reading their whitepapers. You should also investigate the storage options for your crypto before investing.

After determining your risk tolerance, you can start buying cryptocurrency. This is a risky venture, and you should invest only with funds that you can afford to lose. There are many ways to buy crypto, from Bitcoin and Ethereum to the newer, virtually unknown coins released in initial coin offerings (ICOs).

Investing in cryptocurrency is a smart way to diversify your investment portfolio, but it’s best to start small. You can purchase a single coin and use it to purchase other goods or services, or invest your money in a crypto fund. However, it is important to note that the price of one cryptocurrency can drastically fluctuate.

Crypto trading

If you’re interested in learning how to trade cryptocurrencies, the first step is creating an account on a cryptocurrency exchange. You can choose from a variety of different cryptocurrencies, such as Bitcoin, ethereum, or ripple. After creating an account, you can open a position by choosing the buy or sell option. You can also place limit and stop orders.

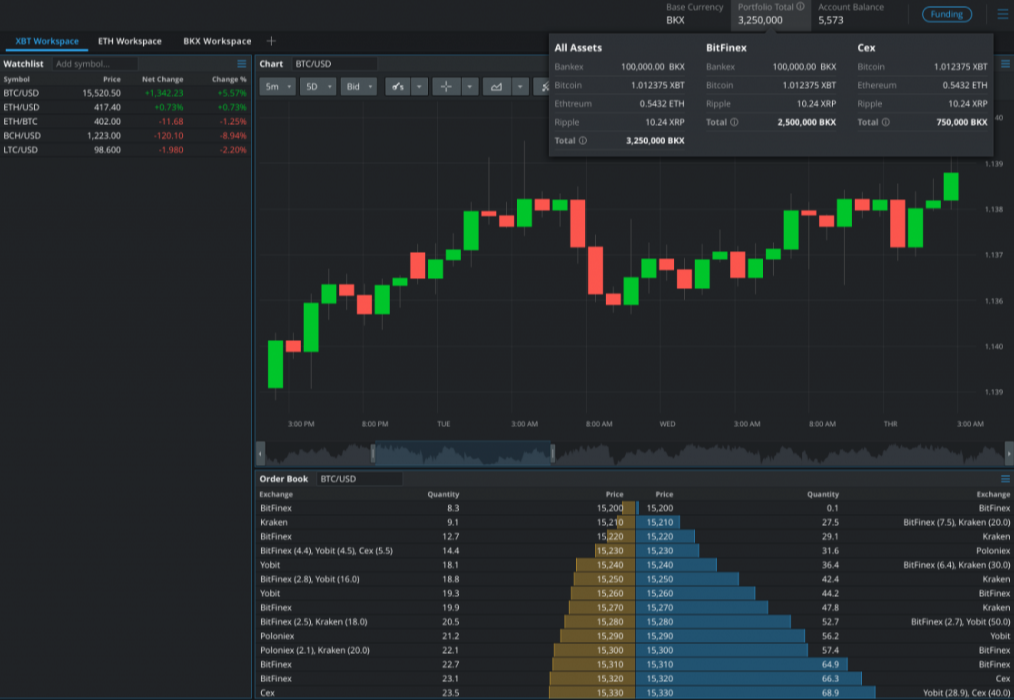

The key to successful trading is understanding how the market works. Each cryptocurrency trade has a buyer and a seller. Because the market is inherently a zero-sum game, understanding how price movements work is essential to minimizing loss and maximizing gain. Buyers will generally set their orders lower than sellers. This creates two sides of the order book, one for the buyer and one for the seller.

Traders can use market analytics tools to make smart trades and stay on top of market sentiment. They should also choose a trading platform that provides them with the tools they need to make smart trades and manage risks. Ideally, they should also be able to customize their trading platform to suit their needs.

Cryptocurrency trading is all about identifying profitable trades and making sure that you’re executing a sound trading strategy. Most investors focus on the major coins, but there are thousands of smaller altcoins that have potential to grow significantly. However, day trading can be challenging and requires nerves of steel. Traders who use technical analysis and market data to make their predictions can make huge profits. However, they can also lose a lot of money, so it is important to have a trading plan to prevent unnecessary losses.

Understanding cryptocurrencies

When it comes to trading cryptocurrencies, you should be aware of their history and how they differ from traditional currencies. There are two main trading analysis methods used in the crypto market: technical analysis and fundamental analysis. Using the right analysis technique can help you maximize your profits and avoid losing money. You can also stake cryptos, which are digital assets that earn you a passive income over time. This method is arguably the most simple and straightforward way to gain from cryptocurrencies in the long run.

The first thing to know about cryptocurrencies is that they are not issued by governments or banks. The creation of new ones is done by mining, which involves solving difficult mathematical puzzles. To create a new bitcoin, you need a lot of computing power. However, the process can be risky. In order to ensure that you are making a safe investment, you should use a wallet that is safe and secure.

Cryptocurrencies are digital tokens that have the potential to revolutionize the financial industry. They are not legal tender in most countries, but the technology that powers them has global implications.

Choosing a cryptocurrency exchange

If you are considering trading in cryptocurrencies, it is essential to choose the right exchange for your needs. This process is important because you’ll be handing over personal information and need to have a high level of trust and confidence in the exchange. It is also crucial that you find out about the exchange’s security practices and compliance with regulations. Moreover, different exchanges have different policies and practices. For example, some exchanges adhere to anti-money laundering (AML) and Know Your Customer (KYC) practices.

Security measures and functionality are other factors to consider when choosing a cryptocurrency exchange. You should choose a platform that offers you a complete range of features and security measures. For example, a secure exchange should offer two-factor authentication and Bitcoin locks to protect your personal data from hackers. Additionally, ease of use is important. Some exchanges can be difficult for new investors, so you may want to look for a platform that is easy to use.

There are hundreds of cryptocurrency exchanges online. Before choosing a crypto exchange, be sure to read the website’s terms and conditions. A good exchange will offer a low fee and high security features.

Using technical analysis

Using technical analysis to trade crypto is a great way to predict price movements and gain a better understanding of the crypto market. In traditional markets, technical indicators are used to predict price movements based on past data. However, the cryptocurrency market is a relatively new asset class and there is a limited amount of historical data to study. Therefore, it has become difficult to predict the future movements of the crypto market. The key is to use multiple technical indicators to help you decide when to enter and exit a position.

When using technical analysis to trade crypto, it is essential to know the tools available and how to use them. This way, you can avoid basic mistakes and increase the value of your investment. In addition, you must study macro-economics and the best projects to invest in. Understanding the tools and concepts behind technical analysis will give you a distinct advantage over the competition.

Candlesticks are another important tool in technical analysis. They represent the activity that took place over a certain time period. Candlesticks are a great way to understand price movements, and are often used by traders to predict price movements. Candlesticks are comprised of a body and wick, which is typically green for an increase, red for a decline.

Investing in cryptocurrencies as a day trader

The 24-hour nature of the cryptocurrency market can be both a blessing and a curse. The lack of predictable trading patterns means that day traders may have to wait longer for the right time to make a trade. The 24-hour nature of the cryptocurrency market also makes it more difficult to find trends. As a result, day trading may become a nighttime affair.

Understanding volatility is a key step in becoming a successful day trader. The volatility of a market is based on several factors, including the news cycle, economic data, research reports, and more. These factors can drastically change the price of a certain crypto asset. The highest volatility is found in smaller-cap altcoins.

There are many different types of trading strategies for cryptocurrencies. Depending on the strategy you use, you can either be successful or a total failure. The key is to have a solid understanding of the different types of trading strategies, and be able to manage risk efficiently.

While a lot of factors are important when investing in cryptocurrency, your skill set is the most important thing. If you can identify profitable positions, you can increase your chances of making more money. Moreover, you can set a stop-loss price. This will help you control your losses and avoid burning your account balance.