How to Sell Crypto on Trust Wallet. There are a few steps that you have to follow to sell your crypto on trust wallet. You should also be aware of the costs, taxes, and slippage rate when selling your crypto on trust wallet. This article will walk you through the steps to sell your crypto on trust wallet. The following paragraphs provide an overview of the process.

Taxes involved in selling cryptos on trust wallet

While many people invest in cryptocurrencies through various exchanges and wallets, there are a few things you need to know about taxes involved in selling cryptos through Trust Wallet. In general, a crypto tax software will aggregate your transactions across different wallets and exchanges, generating a tax report in minutes. This software will also import transactions from Trust Wallet.

Many tax authorities have begun cracking down on crypto and have pressed crypto exchanges to share their customer information with tax authorities and make their systems more secure. In particular, Trust Wallet is one of the largest wallets, partnered with Binance, so it is likely that it has been under pressure from tax authorities. If you want to avoid receiving a letter from the tax authorities, you need to ensure that you are reporting accurate and complete taxes.

Decentralized finance has gained in popularity in the past year. This type of cryptocurrency allows you to transact with other users without an intermediary. It also provides a new source of income, but it is important to follow the IRS crypto tax guidelines. While the IRS hasn’t issued specific rules about crypto taxation, it has issued a Notice 2014-21 ruling, which essentially declares cryptos as property. This means that you’ll have to pay tax on any income you generate from these transactions.

Capital gains tax is another tax that you must consider when selling cryptos. This tax is not a transaction tax, but rather is a tax on the difference between the selling price and the fair market value of your cryptos. The selling price is the price your cryptocurrency reached in the US dollar market at the time of sale. This price can vary on different exchanges.

The IRS is increasingly stepping up its efforts to track cryptocurrency transactions. They’re using data analytics to identify cryptocurrency users, and they can link the blockchain transactions from regulated exchanges to individual crypto wallets. The governments also use this information to share this information with other governmental bodies, academic institutions, and international governments.

Steps involved in selling cryptos on trust wallet

Selling cryptocurrencies on Trust Wallet is not an easy process. In fact, if you are new to this, you might end up losing your crypto if you use the wrong method or try to sell cryptos to the wrong address. Therefore, it’s important to know the steps involved before selling your crypto on Trust Wallet.

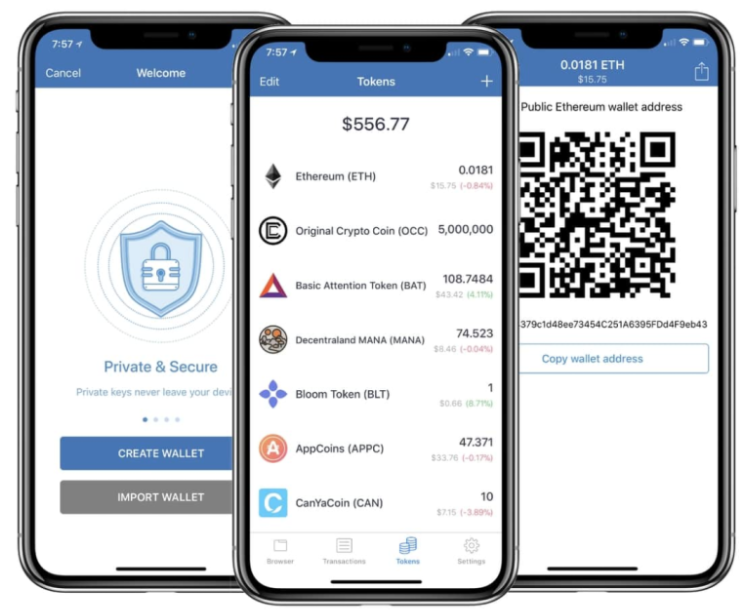

First of all, you need to create a Trust Wallet account. This wallet will allow you to store your favorite cryptos, which you can sell at a later date. This wallet is decentralized, which means you can sell your cryptos without a middleman. Besides, the app will even allow you to trade and store different types of cryptos.

Trust Wallet is free and open source. However, you must keep in mind that it requires an internet connection. In this way, you can sell or swap cryptos with other users. This feature is especially useful for crypto traders who often buy and sell their cryptos. In addition, the trust wallet provides a secure platform for users to interact with other blockchains.

To sell your cryptos on Trust Wallet, you will need to connect your Trust Wallet to a decentralized exchange platform. This can be done through the Trust Wallet app on your iOS or Android device. Once you have connected your Trust Wallet to a Dapp, you’ll need to provide your identifying address.

Once you have verified your identity, you can then proceed to sell your cryptos through your Trust Wallet. First, you’ll need to send your cryptocurrency to the Binance exchange. Once your cryptos are sent, Binance will give you the payment and you’ll be able to withdraw them. The transaction can take anywhere between 30-60 minutes to complete. Once completed, you can withdraw your cryptos in the amount that you need.

Next, you’ll need to decide which coins you want to sell. It’s important to remember that cryptocurrency transactions are more anonymous than traditional banking transactions. Trust Wallet has strict guidelines for DApps that are allowed to be listed in its Marketplace. Trust Wallet also offers a Web3 browser, so you can easily access the marketplace and conduct your transaction. You can even buy cryptocurrencies directly through the app if you aren’t yet a member of the platform.

Cost of selling cryptos on trust wallet

When selling cryptos on Trust Wallet, a few factors need to be considered. First, the network fee. This fee is the cost of completing two transactions using the Ethereum network. This fee is collected by miners who validate blocks of transactions. The network fee depends on factors such as the urgency of the transaction, the cryptocurrency and its settings. To avoid unexpected fees, it is recommended to check the network fee of different cryptocurrencies before executing a transaction.

Another factor to consider is the amount of transaction fees. Generally speaking, fees are linked to the transaction amount, so the less data that is transmitted, the lower the fee. The fees can also vary greatly depending on the market and the network capacity. However, the transaction fees are linked to the network, so the more you spend, the higher the transaction fee.

After you have chosen the right cryptocurrency exchange, you need to verify your identity. Most exchanges require you to enter an email address, phone number, and sometimes a photo ID. In some cases, they may ask you for a proof of address as well. Depending on the exchange, you can also choose a two-factor authentication method to increase the security of your account.

Before selling cryptos on Trust Wallet, you should know the minimum amount of Bitcoin that you need. You must first create an account on a cryptocurrency exchange. Most popular cryptocurrency exchanges allow for both free and paid accounts. Binance is a popular exchange that supports over 60 fiat currencies. Additionally, the exchange allows users to deposit and withdraw funds from their bank accounts or debit cards.

While most wallets charge transaction fees, the Trust Wallet doesn’t. These fees are for the network to process your transaction. These fees go to the Ethereum network to power the system. Unlike other wallets that charge fees, these fees go straight to the network. Aside from the transaction fees, the network also charges gas fees, which can vary from one coin to another.

Besides accepting Ethereum, Trust Wallet also supports Ethereum Classic and all ERC20 and ERC223 tokens. This means that you can use it as a safe and secure crypto wallet for your cryptocurrency. Another benefit of using Trust Wallet is that it accepts credit cards, making it easy to buy Bitcoin with them. To make the process even simpler, you can also use their app. All you need to do is install the Trust Wallet app and tap on the Buy button.

Slippage rate involved in selling cryptos on trust wallet

The Slippage rate is the amount of difference between the expected and actual price of cryptos. This difference can be negative or positive. If it is negative, the price will be lower. However, if it is positive, the price will be higher. Depending on the slippage rate, it can be beneficial or negative depending on the price volatility.

Uniswap users can set their slippage tolerance by clicking on the “gear” icon. This will give them the flexibility to adjust the minimum amount of cryptocurrency to be sent and received. However, this setting can have an impact on the success or failure of a transaction.

Slippage is especially significant during times of major announcements. During such times, the market tends to become volatile and investors should be extra cautious. For instance, a project may announce an upgrade, which can greatly affect the price. Therefore, it is important to invest in assets that have a high market liquidity.

Slippage is a major risk of Trust Wallet trading. If you lose all your funds in a single transaction, you can lose a substantial amount of your crypto. This is the reason why it is important to use a reliable and trusted wallet for your transactions. It is also important to check the amount of liquidity a token has on a particular exchange. If a token has a low liquidity, it can have a big price fluctuation in a very short period of time.

Another risk of slippage is the time it takes to execute an order. A high slippage can delay your order and make it impossible to execute it. This risk can be minimized by breaking up large purchases into multiple smaller ones. This strategy can be particularly effective during off-peak hours and if you’re using a Layer 2-based decentralized exchange with good liquidity.