Marinade Finance Review. Marinade Finance is a decentralized finance platform with a 2% fee for advanced staking. The fee goes to the platform’s partners. Marinade Finance’s smart contracts have been audited three times by independent third parties. They are compatible with multiple decentralized finance protocols. Users can withdraw funds immediately after paying a fee. They can also diversify across multiple validators. They’re a good choice for people who want to invest in the DeFi industry.

mSOL tokens are a receipt for staking

Marinade Finance mSOL tokens serve as a receipt for staking SOL tokens on the platform. These tokens are issued to investors to represent the staked SOL tokens, and can be redeemed in secondary markets. Marinade Finance mSOL tokens have a 6% APY and are compatible with most DeFi protocols.

Users of the platform can use mSOL tokens to do recursive borrowing on Larix and Solend, and for launching NFT mints. The platform uses a tool called the Metaplex Candy Machine to manage and create fair mints, and it accepts mSOL tokens as payment for NFTs.

The tokens are backed by a USDC loan. If you want to sell your mSOL tokens, you can use the USDC borrowed to buy another token. You can also sell mSOL in pools, such as Saber, and mercurial. You will receive a discount on the mSOL tokens you sell.

Among the major DeFi apps, Marinade Finance is the most popular. It’s also the most profitable, allowing users to earn a fixed percentage of their SOL stake. They offer a low fee for rewards and offer yield farms for mSOL. Another great feature is that they support liquid staking on many chains.

Marinade Finance mSOL tokens serve as a receipt for staking, and users can use the mSOL to make payments. As a result, mSOL tokens have a higher liquidity value than STO tokens. This makes them an attractive option for traders and investors.

Users can withdraw funds immediately by paying a fee

Marinade Finance is a non-custodial liquid staking option that makes use of derivative tokens. The benefits of this method include the fact that you never have to worry about your funds being locked up and can easily withdraw them at any time. As an added bonus, you will have voting rights when it comes to platform changes. The fees you pay for stakes are minimal compared to other options.

The fee is between 0,3% of your investment. However, you can avoid the fee altogether by using the delayed undocking feature. This feature allows you to stake assets without waiting for the stakeout reward to be confirmed. In addition, Marinade Finance participates in liquid mining, which helps protect the Solana blockchain and maintain its decentralization. Net betting is another feature of Marinade Finance that allows users to earn passive income while limiting their risk. The tokenized representation of staked assets acts as claims against the underlying stake position, eliminating the need for an automated market maker.

The mSOL token is a tokenized version of the SOL token, and users can use this token to earn passive income. In addition, investors can use mSOL to trade in secondary markets and to receive rewards for staking. Because the mSOL tokens are liquid, they can be traded or transferred outside of the platform.

The mSOL token has potential to replace SOL in the future. This will allow users to earn staking rewards that will increase their investments. In addition, mSOL holders can earn voting power on platform proposals. Additionally, they can become Marinaders in Discord.

The mSOL token is used in the decentralized finance protocol, which uses the Solana blockchain. It is a no-custodial, liquid stakeout protocol that operates on the Solana blockchain. Users stake SOL tokens to hundreds of validators. These tokens earn compound interest and are usable in the secondary markets and in different decentralized finance protocols. Additionally, users can bypass the waiting period by purchasing mSOL native tokens (MTNT). These tokens are also known as mSOL.

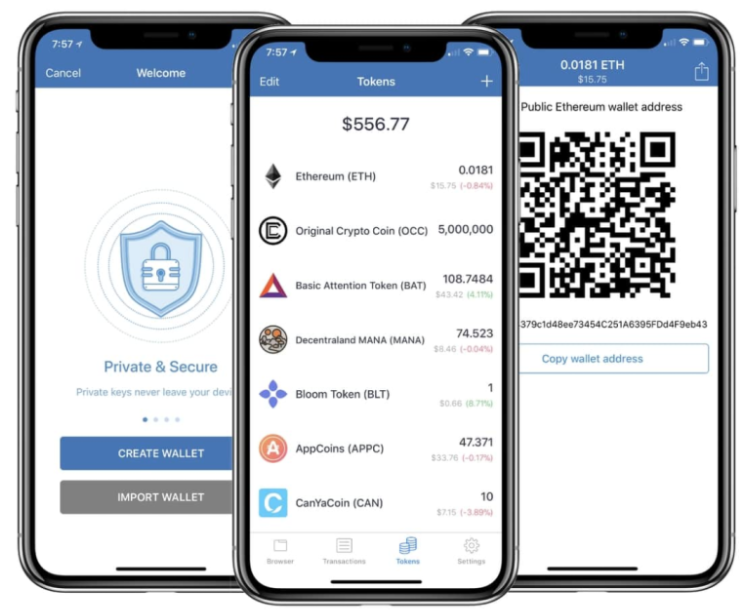

The mSOL token is available on various cryptocurrency exchanges. These exchanges offer low fees, ease of use, and 24-hour customer support. To buy the mSOL tokens, users need a computer or smartphone with internet access, photo ID, and a means of payment.

mSOL tokens are compatible with a range of decentralized finance protocols

mSOL tokens are a form of security that is compatible with a variety of decentralized finance protocols. The tokens are used for collateral and lending on the DeFi platform. They earn yield on their underlying SOL, and can be unstaked by investors for a fee or free. Unlike other decentralized finance tokens, mSOL tokens do not have a central authority.

mSOL tokens are compatible with the Marinade protocol. Marinade offers a stake account for mSOL tokens that pays 6% APY. You can unstake your tokens at any time without incurring any fees, and you will be rewarded with a percentage of the stake price each time you unstake. This eliminates the typical three-day “warm-up” and “cooling-down” period associated with Solana.

Marinade is a protocol designed to facilitate the integration of mSOL tokens in a wide range of DeFi solutions. While the protocol hasn’t yet gone fully open source, Marinade’s roadmap states that the codebase will be publicly available in the future. mSOL tokens are compatible with many of the features of the Marinade ecosystem, including liquidity provision and single-asset staking.

If you’d like to trade mSOL tokens for SOL tokens, you can visit the Marinade DeFi page. It has a list of options from different protocols that have integrated mSOL. Some of these include Sunlight, Larix, Raydium, and Sythetify.

To purchase mSOL tokens, visit one of the cryptocurrency exchanges that support the cryptocurrency. The exchanges are often user-friendly and offer 24-hour customer service. To make an account, users must provide a valid email address and photo ID, and they can also choose to use a preferred payment method to deposit their funds.

Solana has a diverse ecosystem that includes social media applications, blockchain gaming platforms, and decentralized finance protocols. Its blockchain is capable of processing over 60,000 transactions per second. One of its most popular smart contract-enabled blockchains, Solana boasts next-generation scalability.

The advancement of decentralized finance protocols has made it possible to use cryptocurrency in new and innovative ways. These new methods enable users to use them to create new financial services and products. They have also opened up new markets for startups.

Users can diversify across multiple validators

The Marinade Finance platform offers a unique opportunity for users to diversify across multiple validators and benefit from decentralized, distributed ledger technology. By delegating a stake to multiple validators at one time, users can effectively mitigate the risk of a single validator performing poorly. The company has an extensive network of validators in place and maintains decentralization while maintaining security and transparency.

As part of its recent funding from Solana Foundation, Marinade Finance built an automated stake bot for institutional holders who may not be able to delegate their full stake authority to Marinade. The bot will monitor the performance of validators and rebalance a user’s stake in proportion to its performance. Users can then trade stSOL for $SOL in the open market.

The system also enables users to diversify across multiple validators, which act as cut insurance for their bets. Diversifying across multiple validators allows users to spread their stakes across multiple validators, and in a case of a single validator going rogue, the stakes will only account for a small percentage of a user’s total funds.

The token is also used to facilitate protocol ownership liquidity and a reserve fund for strategic partnerships. It is also used for resource auctions on the Marinade Finance website. Currently, the token is trading for $0,31 and has a market value of $17,5 million.

As a liquid stakeout protocol on the Solana blockchain, Marinade Finance users can wager their SOL tokens in a decentralized way to earn compound interest. They also contribute to maintaining decentralization throughout the entire Solana ecosystem. Marinade Finance users can also leverage their mSOL tokens to invest in secondary markets and various decentralized finance protocols.