What is the Scalping Trading Tactic? Scalping is a short-term trading strategy that involves entering trades for a short period of time to catch swift price moves.

It can be a highly profitable technique if used correctly. It requires a lot of discipline and is usually only adopted by experienced traders.

Scalping can also be an effective way to build muscle memory for taking profits, which is a major challenge for many traders.

It is a short-term trading strategy

The scalp trading tactic is a short-term investing strategy that involves making many small trades rather than fewer large ones. The premise behind this is that it is easier to profit from tiny price movements than larger ones. This can be especially useful if markets are volatile, as it may allow a scalper to limit their losses.

Traders who employ this trading technique use technical analysis to identify trading opportunities. They also use charts and indicators to create entry and exit points for their trades.

Scalpers seek to make profits from small movements in the market prices over extremely short time frames, typically seconds to minutes. They can then repeat this process several times during a day, and the small profitable trades can add up to a larger amount.

Some traders who adopt this strategy rely on their discretion to place their trades, while others rely on computer programs that automate their strategies. Some of these programs can be quite complex, and they require a high degree of skill and experience.

In addition, this strategy requires discipline to ensure that a set profit or loss level is reached. This can be difficult for many traders, but it is important to maintain a strict scalping strategy.

To avoid losing too much money, scalpers should only trade during the most liquid times of the day. They should also ensure that they have enough capital to cover their transactions.

Another factor to consider is spreads. This is the difference between the bid and ask price of a stock. When spreads are tight, it is easier to enter and exit positions quickly.

The scalping strategy is a good choice for traders who are looking to make a lot of profit in a short period of time. It is a low-risk strategy, but it can lead to losses if you are not careful. If you are not sure if this strategy is right for you, it is best to consult a professional. This will give you advice on how to make the most of your investments and determine whether this is a strategy that suits your goals.

It is a day trading strategy

The scalp trading tactic is a short-term trading strategy that involves buying and selling a stock multiple times during the day. Scalping is a popular strategy for day traders who want to take advantage of short-term price movements and market volatility.

A scalper’s goal is to make a small profit across many smaller transactions, not a large one on each trade. This means that the profit margin is much lower than it is when swing trading or other longer-term strategies.

To scalp well, you need to be disciplined and follow a strict exit strategy. If you’re not, it’s possible to lose money quickly in this strategy.

You also need to find a broker that offers low trading costs and direct market access. This allows you to minimize transaction costs, which can make this strategy more profitable.

Another thing you need is an efficient trading platform that allows you to track multiple stocks and indicators at once. Using multiple indicators helps you spot trends and market volatility more effectively.

A stochastic oscillator is a momentum indicator that identifies overbought and oversold conditions in the market. It is a good choice for scalping because it can help you identify a price change that could be an opportunity to open a long position.

The 5-minute chart below shows a downward price move that creates an oversold reading on the Stochastic indicator. It can be a great opportunity to enter a long position, especially if you place your stop loss below the low that created the oversold reading.

You can use this technique in any kind of market, but it’s most effective in stocks and futures. The E-mini contract is a good option for this type of trading since it has low volatility and presents several trading range opportunities throughout the day.

As a result, the scalping strategy can be quite lucrative for traders who are willing to commit the time and effort required to execute this trading strategy properly. However, it’s not for everyone. It’s best suited for traders who have the patience and time to dedicate to scalping, as well as those who are more familiar with technical analysis.

It is a swing trading strategy

The scalp trading tactic is a short-term investing strategy that relies on charts and technical analysis to profit from market trends. It typically requires a smaller time frame than swing trading and is best for novice traders and retail investors.

The trader enters a limit order to buy a set number of shares at a certain price. They then watch for positive movements and close the trade if they see an improvement. This strategy is a good way to make money quickly, but it’s also risky.

Scalping is a high-risk trading technique that can lead to large losses. In this case, it’s usually better to use a stop loss order.

This strategy is based on the belief that small moves in the stock market are more profitable than large ones. It also involves setting tight trading windows in terms of both price movement and time frame.

It is also less stressful than day trading and requires fewer resources. Swing trading requires fewer orders than scalping, which means that the trader will incur fewer costs in the long run.

Another factor that makes this strategy a great choice for beginners is the fact that it doesn’t require the trader to monitor their holdings continually. This can help reduce the stress level of the trader, and they can focus on developing a trading strategy and learning the skills necessary for success in the market.

In addition, this type of trading can be done with a small account. It can be a good strategy for beginners, but it can also be used by experienced traders.

A common scalp trading tactic is to use the stochastic oscillator to determine when a stock is oversold or overbought. This strategy can help you spot a potential price turnaround and make the most of your trades.

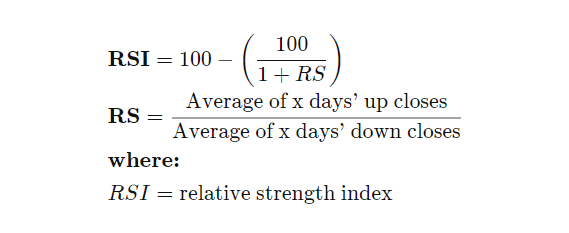

The RSI indicator is also used by some swing traders because it identifies overbought and oversold market conditions. In addition, it can identify trend reversals.

The main difference between a scalp and swing trading strategy is that swing traders hold positions for days or weeks, while scalp traders only stay in their positions for a few minutes. This allows them to avoid gaps caused by news announcements that can cause a big move in the stock.

It is a position trading strategy

The scalp trading tactic is a method of day trading that involves buying and selling stock several times during a single trade. Traders use this strategy to capture small profits from quick changes in the bid-ask spread on the market. It’s an efficient and profitable strategy, but it requires intense focus and concentration.

Scalping is not suitable for everyone, but it can be useful to traders with a lot of time to spend watching the markets and taking positions on stocks that have strong short-term price movements. It’s also a good strategy for traders who want to make a high profit in the long term by taking advantage of smaller price movements.

A good way to start is to look at charts and technical indicators, such as the Relative Strength Index (RSI). This indicator has a buy signal when it dips below its 30 day moving average line, which means that prices are heading lower. It also has a sell signal when it rises above its 70 day moving average line, which means that prices have started to rise higher.

This can help you enter and exit positions quickly without causing too much damage to your portfolio. However, it’s important to note that scalping is risky and can result in losses if you don’t follow the right strategies.

Another important component of this trading strategy is a stop loss. This will allow you to close your position at a safe level, but it’s important to remember that it’s best to place a stop loss as close as possible to the current market price.

Often, scalpers will use Exponential Moving Averages (EMA) to help them determine when to trade. These EMAs place more weight on the most recent data points, which can lead to more consistent results.

A common scalping strategy is to buy stocks when the 50-day moving average cross crosses above the 100 and 200 day moving averages, which is a sign of a new long-term trend. This can be a great way to get into the market when it’s in a bullish phase, but it can be difficult to predict whether or not it will turn into a bearish one.