Why is Bitcoin Valuable? There are a lot of people who don’t understand why Bitcoin has become so valuable. The answer to that question is a little bit tricky.

Bitcoin is a decentralized, peer-to-peer digital currency that uses blockchain technology to transfer value. This technology ensures that transactions are secure and cannot be censored.

1. It’s a form of money

Bitcoin is a form of money because people use it to pay for goods and services. It’s also a way for people to transfer money quickly and securely between each other. It’s also useful for making transactions outside of the conventional financial system, such as in countries that have no traditional bank system.

Unlike many other currencies, bitcoin is a peer-to-peer digital currency that’s not controlled by a central authority. Instead, it uses an algorithm to mandate a limited number of coins and to prevent “double-spending.” This creates a system where participants can transact without having to rely on a centralized entity like a bank or payment processor.

This decentralized nature of the network means that nobody has control over the supply of bitcoins, and that no one entity can see what transactions are happening in the system. This is important for privacy, as it allows people to transact without revealing their real identities. It also makes the system more secure, since no single party can reverse a transaction.

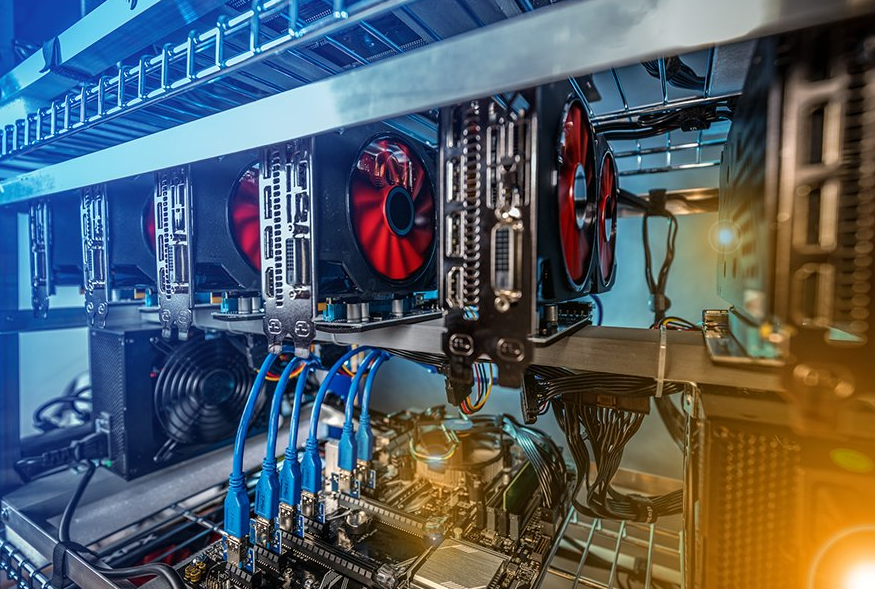

In addition, bitcoin is decentralized because the network is run by thousands of incentivized “miners.” Miners are responsible for verifying each coin unit’s authenticity and preventing double-spending. The resulting system is considered to be more secure than conventional financial systems, which are run by banks and other centralized entities.

It’s also a good example of how technology can improve the way we exchange value. It can make it easier to make international payments and reduce transaction fees, while allowing people to conduct business without exposing their personal information.

Another reason why people value bitcoin is because it’s a source of economic freedom. It’s an alternative to fiat currencies, which are backed by gold and other commodities. This protects against monetary confiscation and censorship, which can erode a country’s purchasing power.

This is why people think that bitcoin could replace gold, as a store of value that’s resistant to inflation. It can also help people avoid the volatility of traditional currencies. Its emergence as a market asset is also driving its price higher. However, many investors are speculating rather than using it for transactions. This is why some experts call the rise of Bitcoin a financial bubble.

2. It’s a store of value

When we think of a store of value, precious metals like gold and silver probably come to mind. These are safe-haven assets that people flock to as hedges against turmoil in traditional markets.

They’re also a great way to diversify your portfolio and protect against economic volatility. These goods do not depreciate over time, making them a stable investment option that can help you to achieve long-term financial goals.

In addition, they’re usually easy to identify and verify, providing confidence in the good’s authenticity and increasing trust levels in future transactions. This makes them a more reliable form of currency than a single asset such as the U.S. Dollar, which does not have an inherent value in and of itself.

A good store of value should be mutually interchangeable and uniform, or “fungible.” This allows for a wide variety of buyers to exchange the good at different times in various locations. It also makes the good more likely to retain its value over the long term, since it’s less likely to be subject to price fluctuations or a lack of liquidity in the buyer market.

This fungibility is especially important for a good that’s scarce or has a fixed supply, such as Bitcoin. A scarce good has a limited supply and is therefore more likely to increase in value over time due to increased demand.

It also helps to be divisible, allowing for transactional ease and the ability to trade smaller parts of the good to maximize its potential. This is a feature that’s lacking in physical real estate, which can be expensive to purchase and manage while often not having the capacity to sell large volumes of property quickly.

These limitations are gradually being overcome with the rise of real estate investment trusts (REITs), funds and fractional ownership models. These models allow you to own a share of the real estate, but come with many compromises including constraints on liquidity and fees that may drag down returns over the long term.

The ability to withstand government confiscation is another factor that’s becoming increasingly important for a good that can be used as a store of value. This is something that’s become an increasingly important issue in the global economy, where governments are acquiring more and more private assets in order to fund their deficits and debts.

3. It’s a currency

The Bitcoin jukebox is a decentralized monetary system with a unique set of characteristics. The most notable is that it doesn’t rely on a centralized authority to propagate its use, which makes for a more streamlined and effective transaction process. In addition, it has a slew of useful tidbits including the ability to send and receive peer to peer payments without the need for a bank or financial intermediary. In short, it’s the most efficient and secure way to send and receive money over the internet.

The best part is that the technology behind it has been around for almost 20 years, making it one of the most tested and true cryptocurrencies in the world. It also happens to be one of the most exciting innovations in monetary history, and one that has helped to create a better, safer world for us all. Its many benefits have already been demonstrated across the globe.

4. It’s a technology

As a technology, Bitcoin allows people to make payments without relying on a financial institution. It does so by creating a peer-to-peer network of computers that use a protocol to establish and safeguard the blockchain, which is a public ledger of all transactions between Bitcoin users. This network is decentralized, meaning that there is no centralized authority to regulate the network.

It is also transparent, as new transactions are added to the blockchain in a decentralized, immutable manner that cannot be manipulated by a third party. This is because the blockchain is based on a system of cryptography. In addition, each transaction is recorded by miners in a distributed fashion, so that no one has control over the blockchain.

The technology is relatively simple and can be used by anyone. In fact, anyone with a computer and an internet connection can participate in the Bitcoin network. This makes it a potentially accessible tool for many people who wouldn’t be able to access traditional financial services, such as international payments or money transfers between countries.

For some, it’s also a safe place to stash cash because there are no fees associated with transactions and the system is secure. However, it’s important to keep in mind that the Bitcoin system is still relatively new and therefore has a lot of unknowns. There are also risks involved with storing and using bitcoins, including theft, hacking and money laundering.

Despite its vulnerabilities, many people believe that Bitcoin has value because of the way it operates. It is a technology that has the potential to transform our current global economic system, so it’s worth understanding why so many people are willing to pay for it. The main factor that gives Bitcoin its value is trust.